Execution Reveals

Your budget, your calendar, and your promotion list don't lie. Everything else might.

The Bank That Couldn't See Itself

In 2016, Wells Fargo fired 5,300 employees for opening 2 million fake accounts.

The fraud wasn't sophisticated. Employees opened checking accounts, savings accounts, credit cards. In customers' names. Without permission. To hit sales targets they couldn't otherwise reach.

Walk into any Wells Fargo branch during those years and you'd see the values poster. Every branch had one.

"Ethics First."

"Do the Right Thing."

"People as a Competitive Advantage."

The sales floor told a different story.

Branch managers set quotas: eight products per customer. Tellers who missed targets got written up. Employees who complained got fired. District managers who flagged the practice got reassigned.

The system was clear: hit your numbers or lose your job.

Here's what makes this fascinating: Wells Fargo's leadership genuinely believed in those values. CEO John Stumpf testified to Congress that the bank had "the best culture in banking."

He wasn't lying. He believed it.

The values poster described what Wells Fargo's leadership thought they were building. The sales targets revealed what they actually built.

Both documents were telling the truth. They were just operating different theories of what mattered.

This isn't a story about bad people. It's a story about a universal mechanism.

Every person, every team, every organization operates with two theories: what they say they believe, and what their behavior implies they believe.

The gap between them is invisible to the self. It only gets exposed when constraints force choices and actions produce consequences.

This is what I call Execution Reveals: the mechanism by which doing exposes what planning carefully hides.

The Architecture of the Gap

Why does this gap exist everywhere?

Because the system that articulates isn't the same system that acts.

Chris Argyris spent decades studying this phenomenon. He gave the two theories names: espoused theory (what we say we believe) and theory-in-use (what our behavior implies we believe).

The gap isn't hypocrisy.

It's architecture.

Jonathan Haidt offers a vivid image: our mind is a rider on an elephant.

The rider (conscious, verbal self) thinks it's steering. It constructs narratives, explains decisions, articulates values.

But the elephant (intuitive, emotional, automatic self) is much bigger.

When rider and elephant disagree about where to go, the elephant wins.

The rider doesn't experience this as losing control. The rider experiences it as having made a reasonable decision, then constructs an explanation for why that decision aligned with stated values all along.

At Wells Fargo, the rider said "Ethics First."

The elephant responded to "hit quota or get fired."

The rider genuinely believed the ethics poster.

The elephant knew which choice kept your job.

Daniel Kahneman's research on System 1 and System 2 thinking reveals the same split. System 1 (fast, intuitive, automatic) runs most of our behavior. System 2 (slow, analytical, deliberate) mostly endorses what System 1 already decided, then claims credit for the choice.

Your strategy deck is a System 2 document.

Your execution is System 1 in action.

No wonder they don't match.

The Four Forces That Expose Truth

If the gap is universal and invisible, how does it ever get exposed?

Through four irreducible forces. Understanding them is the key to reading what execution reveals.

Force 1: The Split

Every person, team, and organization operates with two selves: the Narrator and the Operator.

The Narrator articulates. Explains. Believes.

It writes the mission statement. It drafts the strategy deck. It hangs the values poster.

The Operator acts. Decides. Does.

It allocates the budget. It fills the calendar. It makes the promotion decisions.

At Wells Fargo, it opened the fake accounts.

The Narrator and Operator aren't enemies. They're not even aware they're different.

The Narrator genuinely believes it's describing what the Operator does. The Operator genuinely believes it's implementing what the Narrator articulates.

The gap between them isn't a bug.

It's architecture.

Edgar Schein's research on organizational culture shows this same split at the institutional level. He identified three layers: artifacts (what you can see), espoused values (what the organization says it believes), and basic assumptions (what actually drives behavior).

The espoused values and basic assumptions are often different.

And the organization is usually unaware of the difference.

Wells Fargo's Narrator said "Ethics First."

Wells Fargo's Operator said "eight products per customer."

Both were sincere. Only one drove behavior.

The inversion: Don't read the values poster. Watch what survives when choices must be made.

Force 2: The Squeeze

The gap stays hidden when resources are abundant.

When you can fund everything, you never have to choose.

When there's time for every meeting, priorities remain theoretical.

When every goal can be pursued, values don't get tested.

Scarcity forces choice. Choice reveals values.

At Wells Fargo, the squeeze came from Wall Street.

Quarterly earnings calls. Analyst expectations. Stock price pressure. Growth targets that couldn't be met organically.

The Narrator said "serve customers with integrity."

The Squeeze said "show 10% revenue growth or your stock gets hammered."

When those two collided, execution revealed which one actually mattered.

Clayton Christensen's insight about resource allocation cuts to the heart of this: "Where money goes, strategy follows."

It doesn't matter what the strategy deck says. The proposals that get funded might succeed. Everything else starves.

Resource allocation IS strategy. Not as metaphor, but as mechanism.

Jim Collins found the same pattern in companies that achieved sustained greatness. They had what he called the Hedgehog Concept: a clear understanding of what they would and wouldn't do.

"Anything that doesn't fit, we don't do."

The discipline to say "no thank you" to opportunities that didn't align.

But here's the thing: you don't discover your Hedgehog Concept by planning. You discover it by watching what you actually say no to when resources are constrained.

Chris McChesney named the force that creates this squeeze: the Whirlwind.

The urgent daily demands that consume attention and energy. The inbox that never empties. The meetings that multiply.

What survives the whirlwind is what actually matters.

Everything else was aspiration.

At Wells Fargo, ethics didn't survive the whirlwind. Sales targets did.

That was the revealed strategy.

The inversion: Constraints don't distort truth. They reveal it.

Force 3: The Mirror

Words have no consequences.

Actions produce outcomes.

This asymmetry is why execution reveals truth and planning hides it.

Nassim Taleb's concept of "skin in the game" captures this precisely. Those who bear the consequences of their decisions develop different judgment than those who only advise.

"Don't tell me what you think. Show me your portfolio."

The advisor can say anything.

The investor's choices are constrained by reality.

Talk is cheap because nothing happens when you talk.

Doing is expensive because reality resists.

Carl von Clausewitz, writing about military strategy two centuries ago, identified two forces that make execution different from planning: fog and friction.

Fog is uncertainty. "Three quarters of the factors on which action in war is based are wrapped in a fog of greater or lesser uncertainty."

Friction is resistance. "Countless minor incidents combine to lower the general level of performance."

Plans never encounter fog or friction. They exist in a frictionless world where everything goes according to expectation.

Execution lives in reality, where fog obscures and friction grinds.

At Wells Fargo, the plan was "cross-sell with integrity."

The execution was "open accounts without permission because that's the only way to hit the target."

Reality responded to execution, not to intention.

Customers got fake accounts.

Employees got fired.

The CEO got hauled before Congress.

The mirror only reflects what actually happens.

The inversion: Reality audits actions, not plans.

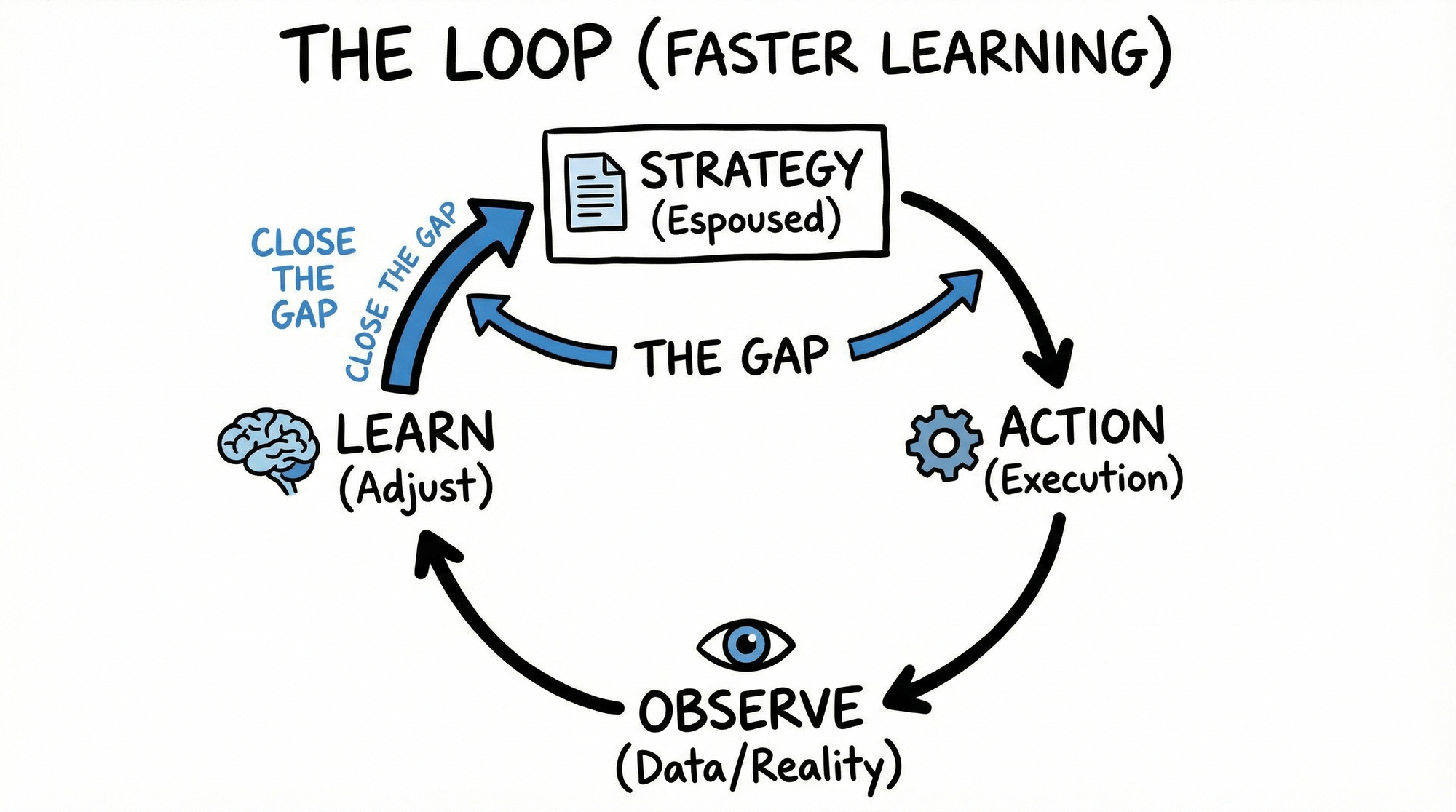

Force 4: The Loop

The gap between espoused theory and theory-in-use doesn't have to stay hidden forever.

It can be closed.

But not through better planning.

Faster learning beats better plans.

John Boyd, the military strategist who transformed fighter pilot doctrine, developed the OODA loop: Observe, Orient, Decide, Act.

His insight wasn't that you needed a better plan. It was that the organization with the faster loop wins.

If you can cycle through observe-orient-decide-act faster than your environment changes, you adapt. If you can't, your plans become obsolete before execution completes.

Argyris distinguished between two types of learning.

Single-loop learning fixes errors within the existing system. The thermostat adjusts the temperature.

Double-loop learning questions the system itself. Why is this the target temperature? Should we have a thermostat at all?

Single-loop learning keeps the gap intact. It fixes symptoms without surfacing the underlying theory-in-use.

Wells Fargo did single-loop learning for years.

Employees got fired.

Branches got audited.

Compliance got tightened.

But the underlying system (impossible targets + consequences for missing them) stayed intact.

Double-loop learning would have asked: Why do we have targets that can only be met through fraud? What does that reveal about our actual strategy?

The goal isn't to control the gap through better enforcement.

The goal is to close it through faster learning.

Align espoused and actual. Then decide if that's who you want to be.

The inversion: The faster the loop, the smaller the gap.

Where the Gap Shows Up

Once you start looking for this pattern, you see it everywhere.

In budgets.

Xerox PARC invented the graphical user interface, the mouse, ethernet, and laser printing. All in the 1970s.

The research budget said "innovation is our future."

But when it came time to commercialize these inventions, the money went elsewhere. Xerox protected copiers.

Steve Jobs visited PARC in 1979, saw the future, and built it. The Macintosh shipped in 1984.

Xerox's R&D budget told one story.

Their commercialization budget told the truth.

In calendars.

When Marissa Mayer became Yahoo's CEO in 2012, she declared innovation and collaboration as top priorities.

Her first major act? Banning remote work. Everyone in the office.

Then the meetings multiplied. Engineers reported calendars so packed they had no time to actually build anything.

Yahoo said it wanted to move fast.

The calendar revealed a company that had institutionalized slowness.

In promotions.

Microsoft under Steve Ballmer explicitly valued teamwork. The company's leadership principles emphasized collaboration.

Yet their stack ranking system forced managers to rate employees against each other on a bell curve. Someone had to lose.

A 2012 Vanity Fair investigation found engineers actively sabotaging colleagues, refusing to share code, avoiding talented team members who might outshine them.

The values poster said collaboration.

The promotion system said compete or die.

Under pressure.

Volkswagen positioned itself as the clean diesel alternative. "TDI Clean Diesel" was the marketing campaign. Environmental responsibility was the espoused theory.

Then regulators started testing.

Under pressure to meet emissions standards they couldn't actually achieve, engineers installed defeat devices in 11 million cars worldwide. The software detected when the car was being tested and temporarily reduced emissions.

VW's marketing said "clean."

Their execution, when squeezed, revealed what they actually prioritized: sales targets over stated values.

The pattern shows up in personal life too.

Your calendar reveals your priorities more honestly than your goals list.

Your spending reveals your values more accurately than your stated beliefs.

What you consistently do is what you actually want.

The gap between that truth and the story you tell yourself? That's your personal theory-in-use, operating in the background.

The Fractal Pattern

This mechanism operates at every scale.

| Scale | Narrator (Espoused) | Operator (Actual) | Revealed By |

|---|---|---|---|

| Individual | "I value health" | Eats the cake | Behavior under temptation |

| Team | "We collaborate" | Hoards information | Actual meeting dynamics |

| Organization | Mission statement | Resource allocation | Where budget goes |

| Market | Survey response | Purchase behavior | What actually sells |

Paul Samuelson formalized this at the economic level with revealed preference theory.

Don't ask consumers what they want. Watch what they buy when they have to choose.

The choice reveals the preference more honestly than any survey.

Dan Ariely's behavioral economics research shows the same gap in individual decision-making. Our stated preferences and revealed preferences diverge systematically and predictably.

We're not randomly inconsistent. We're consistently inconsistent in ways the espoused/actual framework explains.

The pattern is fractal.

Same mechanism, different scales.

But What About Leaders Who Walk the Talk?

You might be thinking: If this gap is universal, what about leaders who actually do what they say? Companies that live their values?

They exist.

But they're not exceptions to the physics. They're proof of the principle.

Leaders who align espoused and actual don't eliminate the gap through willpower. They architect around it through faster loops.

They make the gap visible.

They create feedback mechanisms that surface theory-in-use.

They reward people for pointing out divergence, not punishing them for it.

At Bridgewater Associates, Ray Dalio built "radical transparency" into the operating system.

Every meeting recorded.

Every decision documented.

Disagreement required.

The architecture forces the gap into the open.

Does it work perfectly? No. The gap still exists.

But it's visible, discussable, correctable. That's the difference.

Wells Fargo had the opposite architecture.

Employees who flagged fake accounts got fired.

Managers who questioned targets got reassigned.

The system punished people for surfacing the gap.

The gap didn't disappear at Bridgewater. It just became part of the loop instead of hidden from it.

The inversion: You can't eliminate the gap. You can only make it visible and learnable.

The Diagnostic

How do you read what your execution reveals?

The Revealed Strategy Audit:

- Map Espoused Strategy (your decks, mission, values, communications)

- Map Revealed Strategy (where budget, calendar, and promotions actually go)

- Identify The Gaps (where espoused ≠ revealed)

- Surface Actual Priorities (name what the revealed strategy actually is)

- Decide: Align or Change (update espoused OR change behavior)

Quick Diagnostic Questions:

| Question | What It Reveals |

|---|---|

| What got cut last budget cycle? | What's actually dispensable |

| Where does the CEO's calendar go? | What leadership values |

| Who got promoted? | What behavior is rewarded |

| What survives the whirlwind? | Actual vs. stated urgent |

| What happens under pressure? | Theory-in-use |

At Wells Fargo, the answers would have been clear years before the scandal:

What got cut? Ethics training, customer service time.

Where did calendars go? Sales meetings, target reviews.

Who got promoted? Top sellers, regardless of method.

What survived? Sales targets.

What happened under pressure? Fraud.

The execution was revealing the strategy the entire time.

Leadership just wasn't reading it.

The Invitation

You've always sensed the gap between what organizations say and what they do. Between what you claim to value and where your time actually goes. Between the strategy deck and the budget allocation.

Now you have a name for the mechanism. And a method for reading it.

The gap isn't hypocrisy. It's architecture.

Two systems operating two theories, with only one of them producing consequences.

Wells Fargo's values poster wasn't a lie. It was the Narrator, sincerely articulating what leadership believed they were building.

The sales targets weren't evil. They were the Operator, responding to the actual constraints and incentives.

The tragedy wasn't that the gap existed. Every organization has one.

The tragedy was that Wells Fargo's architecture prevented them from seeing it until 2 million fake accounts forced it into the open.

Your budget tells you what you actually prioritize.

Your calendar tells you what you actually value.

Your promotion list tells you what behavior you actually reward.

Everything else is narration.

The invitation isn't to judge yourself or your organization for having a gap. Everyone does.

The invitation is to get curious about what your execution reveals. To treat the distance between your Narrator and your Operator as information rather than indictment.

What does your theory-in-use say about what you actually believe?

That's the question execution answers.

That's the truth serum nobody can fake.

Explore Further

Each of the four forces has its own deep dive:

The Sincere Liar — Why the gap between what we say and do isn't hypocrisy. It's architecture. Explores THE SPLIT.

When Abundance Becomes Enemy — How unlimited resources obscure truth and constraint reveals it. Explores THE SQUEEZE.

The Doer's Advantage — Why those with skin in the game develop judgment advisors never acquire. Explores THE MIRROR.

Why Faster Beats Better — How learning speed beats planning quality every time. Explores THE LOOP.

Reading What's Really There — The practical guide to running a Revealed Strategy Audit in any organization.

Browse all notes: Shadow Strategy →